1099-K Software

1099-K EFile Software & 1099-K Printing

1099-K Software

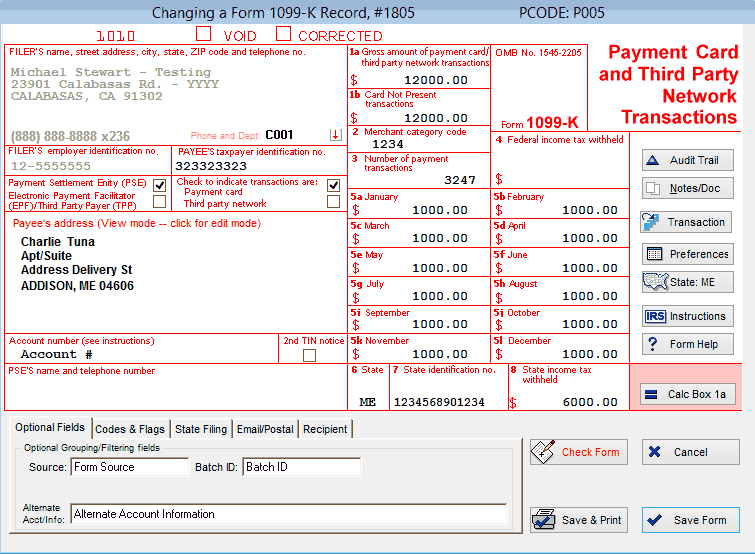

1099 Pro LLC offers a selection of 1099-K efile software and services that make it easy for any payment settlement entity that requires 1099-K printing/filing for Merchant Card and Third Party Network Payments. A payment settlement entity (PSE) makes payments in settlement of reportable payment transactions such as a payment card or third party network transaction. Please visit the links below for more information pertaining to our 1099-K software & filing solutions:

1099-K eFile Software

Business Rules & New Features

Our 1099-K reporting modules contain special features and business rules to help ensure that your forms have been completed to meet the expectations of the IRS/SSA:

- Business rules quickly identify data errors during import and manual entry.

- A Calculation button automatically totals Box 1 (Gross Payments).

- Filers can enter required IRS Merchant Category Codes (MCC) or equivalent industry codes into Box 2.

- Business rules ensure accurate city, state and zip information.

- 1099 Pro tracks the transaction count total to ensure that Third Party Payers (TPP) only report payees with over 200 transactions.

Filer Type Selection

Complete forms under any filer type such as Payment Settlement Entity (PSE), Electronic Payment Facilitator (EPF), or Third Party Payer (TPP).

Simplicity

1099 Pro LLC offers free technical support to all current and potential customers via phone support, and online chat for our software. No matter how complicated your question is, we'll always find a solution.

To get the latest information, please write us online or contact us using the phone numbers and email addresses below:

1099 Pro LLC:

phone: (888) 776-1099

email: support@1099pro.com